michigan.gov property tax estimator

The mathematical equation below illustrates how this is figured. Search Any Address 2.

Mi Treasury Reminds Tax Filers To Check For Homestead Property Tax Credit Eligibility Moody On The Market

The State Education Tax Act SET requires that property be assessed at 6.

. The countys average effective tax rate of 235 is more than double the national average. Get the latest updates and resources from the State of Michigan. See Property Records Tax Titles Owner Info More.

You can now access estimates on property taxes by local unit and. Ad Our Property Tax Records Finder Locates Local Records Fast. Does whole foods accept wic.

This Treasury portal offers one place for taxpayers to manage all their Individual Income Tax needs. The median property tax in Michigan is 214500 per year for a home worth the. Search For Title Tax Pre-Foreclosure Info Today.

Get In-Depth Michigan Property Tax Reports In Seconds. Get help with Tax Preparation. You can now calculate an estimate of your property taxes using the current tax.

This system contains US. Welcome to the NEW eServices portal. Acme township 2013 millage rate.

State of michigan property tax estimator. The Revenue Act includes provisions for charging penalty and interest if a taxpayer fails to pay. Forms - Michigan.

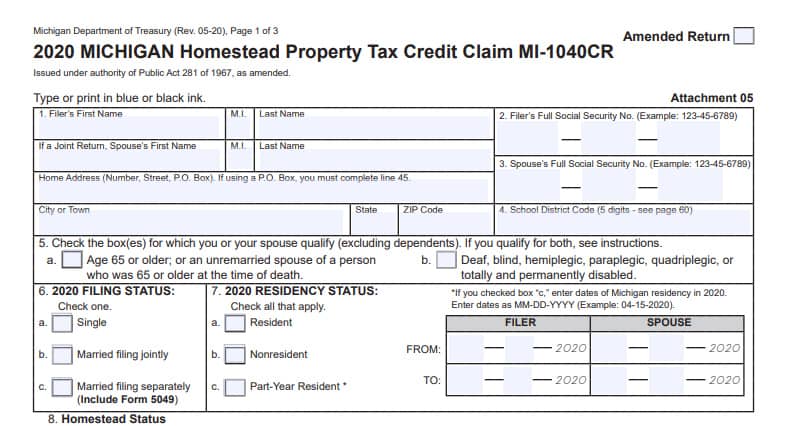

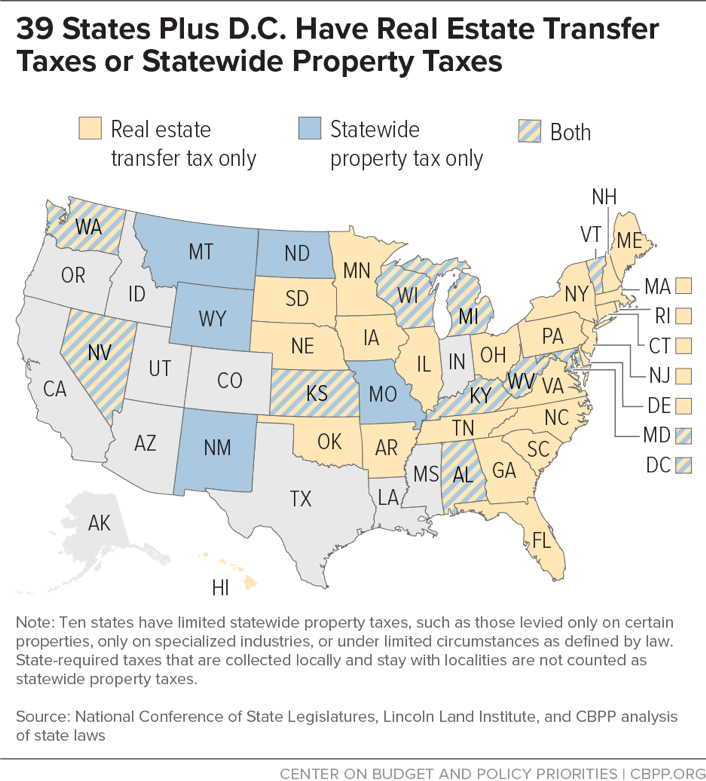

Application for State Real Estate Transfer Tax SRETT Refund. By accessing and using this computer. Be Your Own Property Detective.

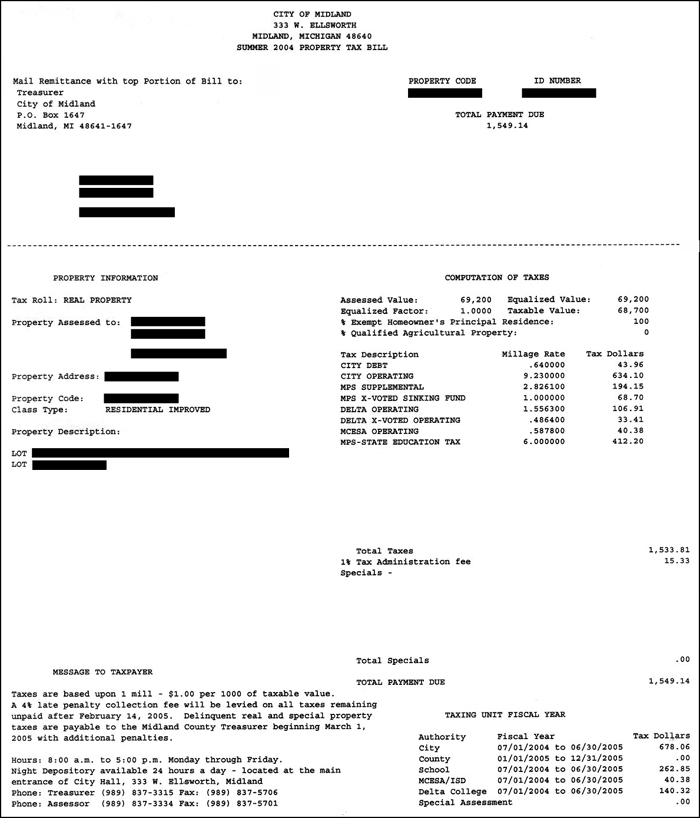

Worksheet 2 Tier 3 Michigan Standard Deduction. Property owners can calculate their tax bill by multiplying their taxable value by the millage rate. 2021 Millage Rates - A Complete List.

Inquire about General Topics. For example if the citys millage rate is 10 mills property taxes on a home with a taxable value of 50000 would be 500. Rainham golf club restaurant.

Michigans Wayne County which contains the city of Detroit has not only the highest property tax rates in the state but also some of the highest taxes of any county in the US. 101000 x 50000 500. The median property tax in Michigan is 214500 per year for a home worth the median value.

Use this estimator tool to determine your summer winter and yearly tax rates and amounts.

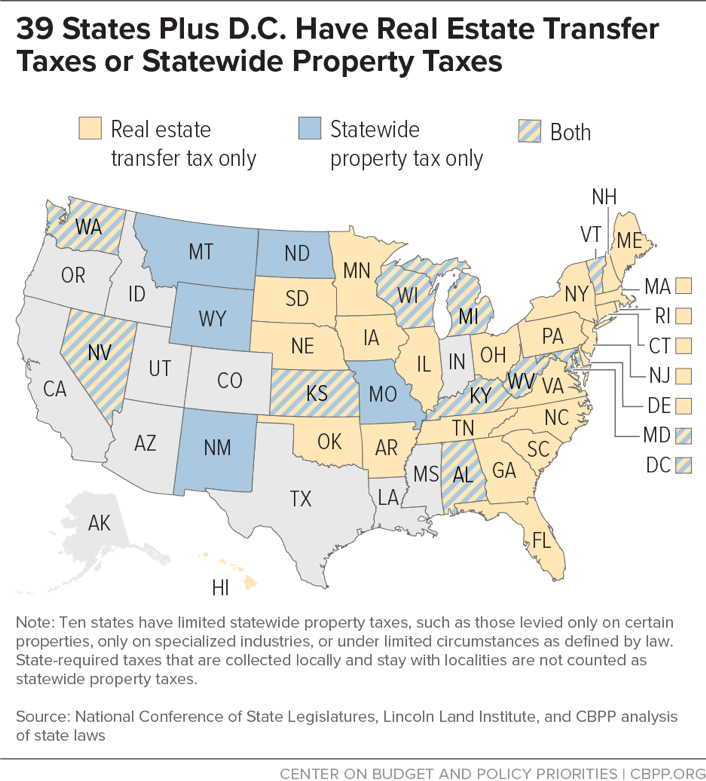

How Do State And Local Property Taxes Work Tax Policy Center

Top Counties With Lowest Effective Property Tax Rates In 2021 Attom

Calculation Of An Individual Tax Bill A Michigan School Money Primer Mackinac Center

Where Are Property Tax Rates Highest And Lowest In Michigan Mlive Com

Treasurer S Office Pittsfield Charter Township Mi Official Website

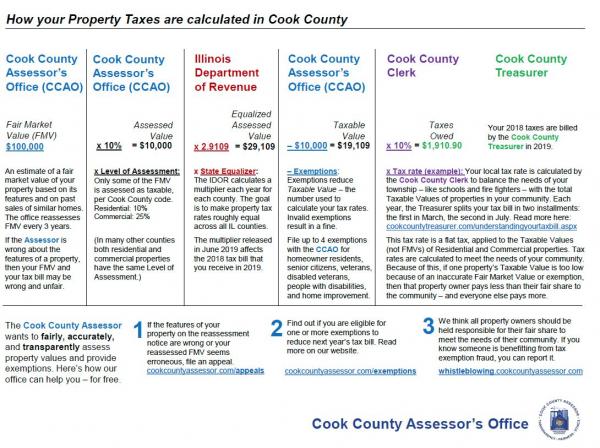

Your Assessment Notice And Tax Bill Cook County Assessor S Office

Michigan Department Of Treasury Taxes

State Mansion Taxes On Very Expensive Homes Center On Budget And Policy Priorities

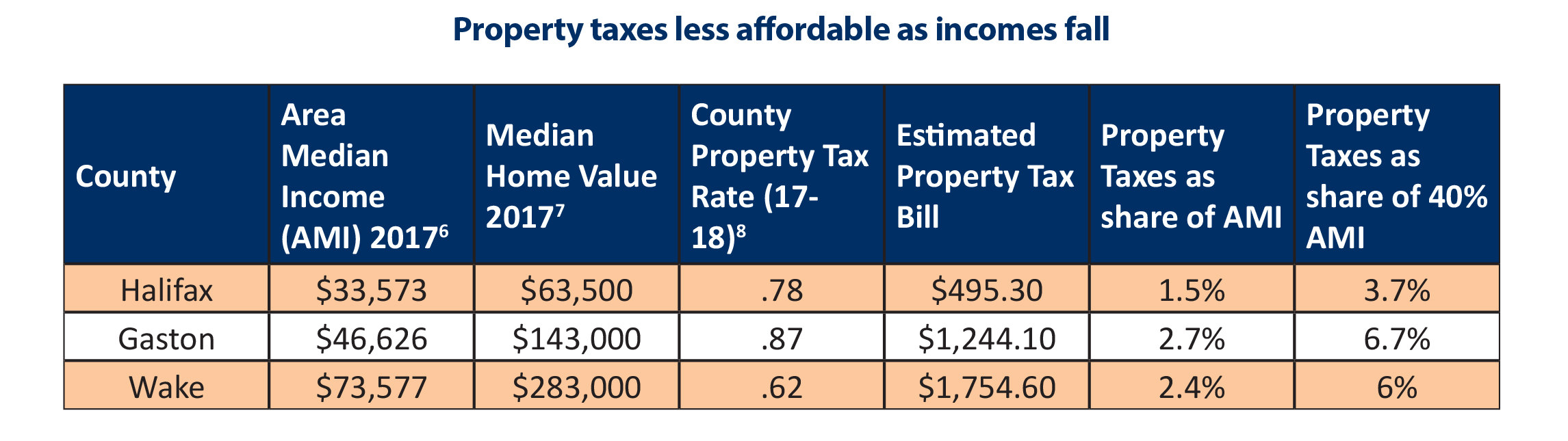

N C Property Tax Relief Helping Families Without Harming Communities North Carolina Justice Center

Taxes Pittsfield Charter Township Mi Official Website

Statewide Average Property Tax Millage Rates In Michigan 1990 2008 Download Table

Property Tax Archives Michigan Property Tax Law

Property Tax Overview Placer County Ca

Tangible Personal Property State Tangible Personal Property Taxes

Property Tax Calculator Smartasset

Prorating Real Estate Taxes In Michigan

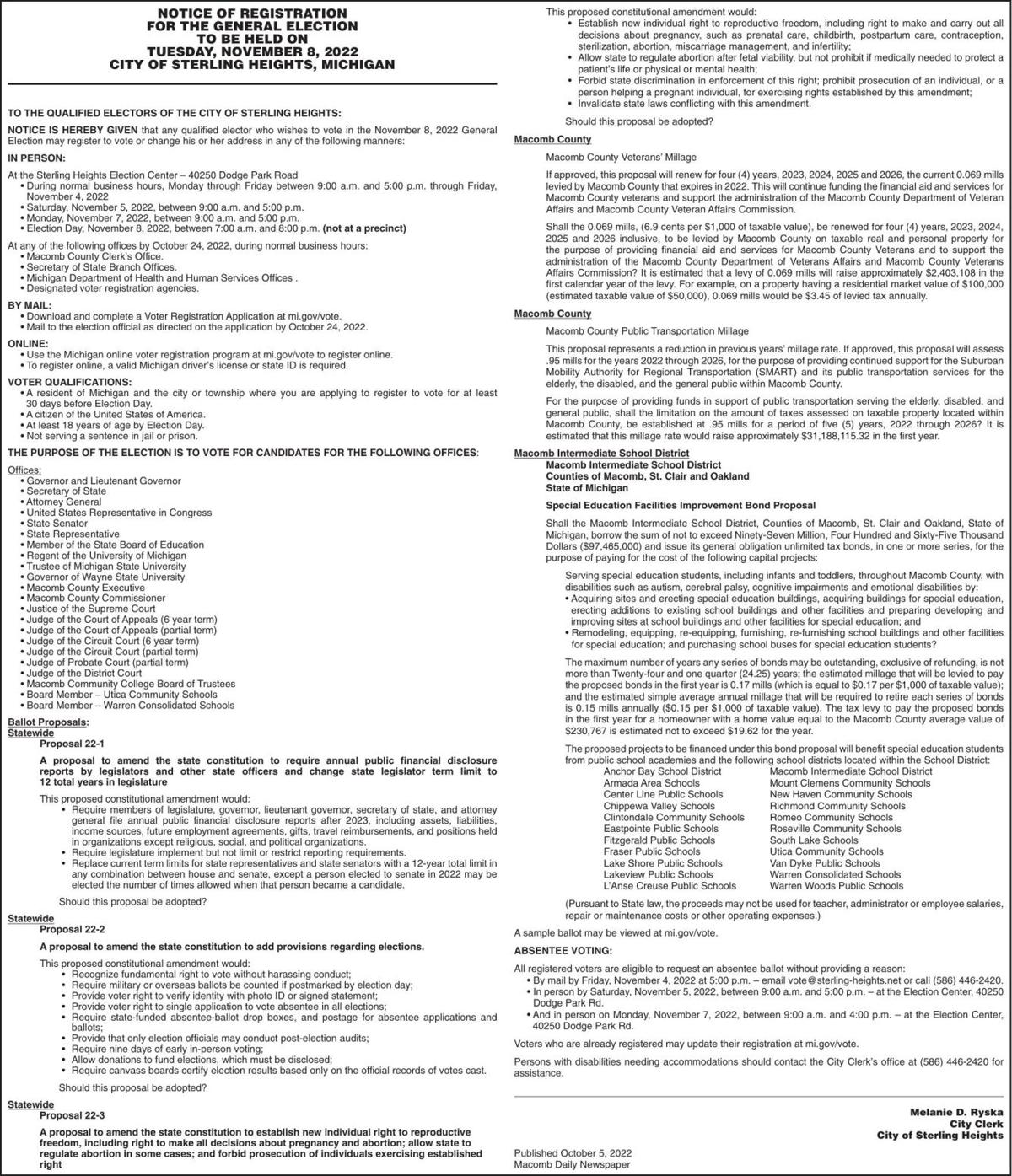

Sterling Heights Po So 1487000 Ads Businessdirectory Macombdaily Com